Blog > Tax Season amp Filing > Are New Windows Tax Deductible?

Are New Windows Tax Deductible?

July 24, 2024 - Friendly Tax Expert

As a homeowner, you may be looking for ways to save money and reduce your tax burden. And if you’re considering upgrading your windows, you may be wondering: Are new windows tax deductible? It’s a common question among homeowners, as the cost of replacing windows can add up quickly.

In this blog post, we will answer the question of whether the cost of your new windows can be tax deductible. By reading this guide, it can help you in making home improvement decisions and potentially save you money in the process.

Can you deduct new windows on your taxes?

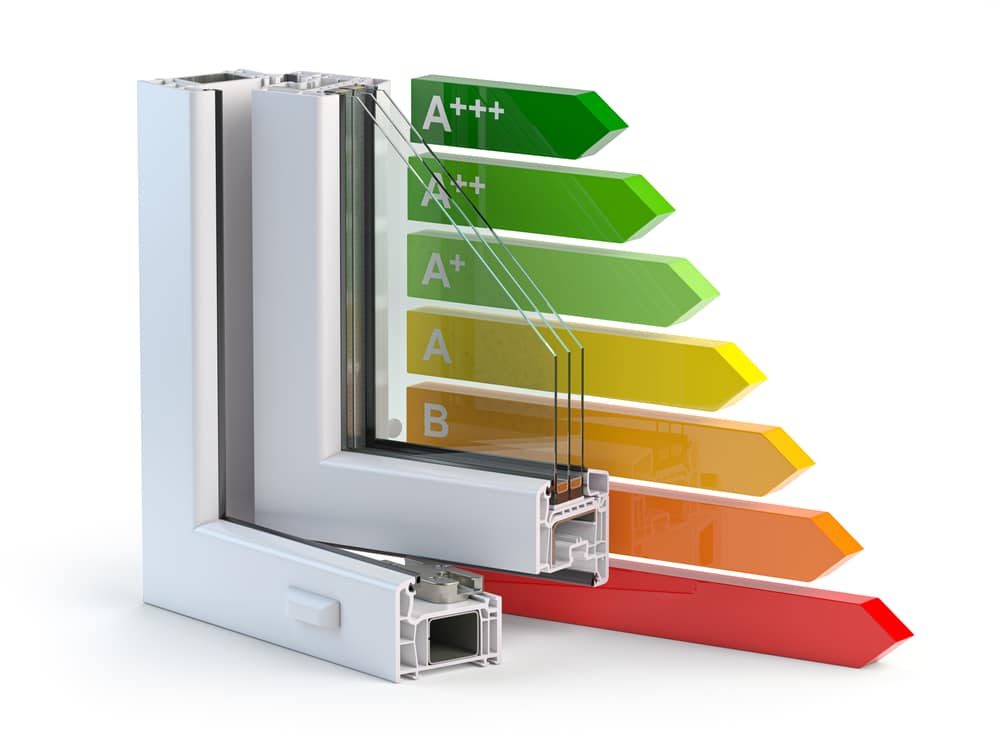

Yes, new windows can be tax deductible as long as they are energy efficient windows that meet certain conditions. For your windows to qualify for a tax credit, they must meet the Energy Star Most Efficient certification.

In the past, home owners could only claim 10% of the costs of new window installation. However, the updated tax credit starting 2023 called the Energy Efficient Home Improvement Credit now allows homeowners to claim up to 30% of the cost for new windows, up to a maximum of $600. This credit applies only to primary residences and not second homes or investment properties.

For example, if you install windows that meet the necessary energy efficiency conditions, you can indeed claim a tax credit for those windows. On the other hand, if you install windows solely for aesthetic purposes and they do not meet these specific conditions, they will not be eligible for the tax credit.

Always ensure you're aware of the exact requirements before making your purchase and installation to benefit from the windows tax credit.

What is the Energy Efficient Home Improvement Credit?

The Energy Efficient Home Improvement Credit, which started in the 2023 tax year and extends until the end of the 2032 tax year, allows homeowners to claim 30% of the total cost of new windows and skylights installed during the year, up to a maximum limit of $600. This credit is part of the Inflation Reduction Act of 2022.

Importantly, the lifetime limit for windows has been removed, enabling you to replace all of the exterior windows in your house over several years while claiming a tax credit of up to $600 each year.

The federal government offers this tax credit on the purchase and installation of select windows, doors, and skylights. This offer is valid from January 1, 2023, through December 31, 2032. There might be other restrictions, so be sure to check out the IRS website for more details.

How do I know if my windows qualify for Energy Star Most Efficient certification?

To ensure that your windows qualify for Energy Star Most Efficient certification, you need to verify that the windows meet the requirements before making your purchase. If you've already purchased windows, you can visit the energystar.gov website to verify if they have this certification.

Look for the Energy Star Most Efficient label, which signifies that the product meets the stringent criteria for energy efficiency. This step is important to ensure that you can claim the tax credit for your energy efficient home improvement project.

Will the cost of the entire window installation be deducted from my taxes?

No, only 30% of the cost of the new windows and skylights installation will be deducted from your taxes, with a maximum credit of $600.

For example, if Earl installed new windows costing exactly $2,000, he would receive a tax credit of $600. This is because 30% of $2,000 is $600, which is precisely the maximum limit allowed.

On the other hand, Jess, who has a large house with many windows, spent $5,000 on new windows. Although 30% of $5,000 is $1,500, she can only claim a maximum of $600 despite her higher expenditure.

To maximize your benefits, you can plan to replace windows over several tax years, claiming the credit each year until your project is complete. This way, you can make the most out of the property credits offered for energy efficient windows.

Can I claim this tax credit if I replace windows in multiple properties?

No, you can only claim this tax credit for your primary residence. Vacation homes or rental properties are not eligible for this tax credit.This means that if you have multiple properties, you can only claim the credit for one of them.

Additionally, the home must be located in the United States and it has to be an existing home. New house builds cannot claim this tax credit.

But what if you replace the windows of a house you are just renting? Can you claim the credit then? Yes, you can if you have listed that property as your primary residence and meet all other criteria.

Keep in mind that the tax credit for energy efficient home improvements is non-refundable. This means that you can only receive the credit up to the amount of taxes you owe to the Internal Revenue Service (IRS). If you do not owe any taxes for the year, you will not receive a refund for the credit amount.

Get help from tax resolution experts

Navigating taxes can be a headache. If you're not sure how to claim the tax credit for energy efficient windows, it's best to seek help from professionals. Tax resolution experts can guide you through the process and ensure that you receive all the credits and deductions you are eligible for.